A lot of car insurance companies offer tracking devices drivers can install in their vehicles to potentially reduce their premiums. Essentially, these tracking devices reward drivers for safe driving.

A lot of car insurance companies offer tracking devices drivers can install in their vehicles to potentially reduce their premiums. Essentially, these tracking devices reward drivers for safe driving.

However, insurance companies are focused on their bottom lines. That raises the question: what else might the insurance company be tracking with these discount devices? And how might they use that data in the future?

Below, the our car accident attorneys in Fort Worth discuss the risks of having an insurance tracking device in your vehicle, particularly after a crash that was not your fault.

How do Insurance Tracking Devices Work?

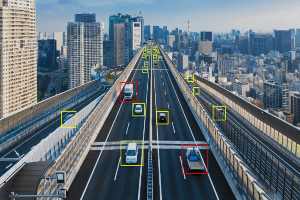

The official name for these tracking devices is telematics devices. Although each company has a different trademarked name, they essentially all do the same thing: track your driving.

These devices connect to your vehicle’s computer system and send data back to the insurance company for interpretation, such as data on:

- Speed

- Mileage

- Location

- Phone use

- Braking habits

- Traffic patterns

Data on speed and mileage help insurers determine your driving patterns. Insurance companies may also use these devices to track where you park and the places you frequently visit. For example, if you park your car in an area with high rates of burglary or vehicle theft, your insurance premium may increase. The insurance company is trying to protect itself in case your car gets stolen or damaged in a burglary incident.

Other Data Insurance Companies May Collect

Not only do these telematics devices collect your driving habits and track you using GPS, but they could also potentially be collecting other data such as phone call records or other data available through your Bluetooth devices.

It is unclear how well insurance companies secure this data and whether it is encrypted, so your sensitive information could potentially be exposed.

Another risk of using telematics devices is that insurance companies may be able to sell your data to third parties, like advertisers, for a profit.

How Can my Data be Used Against Me?

The data collected from a telematics device may be used to review your driving patterns and, if you are filing a claim for an accident, it could be used to deny your claim based on something as minuscule as driving five miles over the speed limit. Luckily, our attorneys are prepared for situations where the insurance company baselessly denies a claim.

That said, you should be cautious about agreeing to install a telematics device in your car. How much money would it really save you each month? If the answer is not that much, does it make sense to give the insurance company data that may be used against you?

You should also consider the insurance company’s reasons for asking you to use the device. Is it because they want to save you money? Is it because they want to collect more data about you to serve their interests?

Call to Ask for Legal Assistance

Insurance companies deny claims for many reasons. Hiring an experienced attorney who knows how these companies operate may give you a better chance at recovering the compensation you need for medical bills, lost wages and other damages.

Our attorneys are prepared to take on the insurance company on your behalf so you may focus on recovering from your injuries. We do not charge you anything up front or while we work to build your case, and we only get paid if we recover compensation on your behalf.

Call today to schedule your free consultation: (817) 920-9000.